403b Retirement Contribution Limits 2024

403b Retirement Contribution Limits 2024. The 401k/403b/457/tsp contribution limit is $22,500 in 2023. Your contribution and your employer’s contributions.

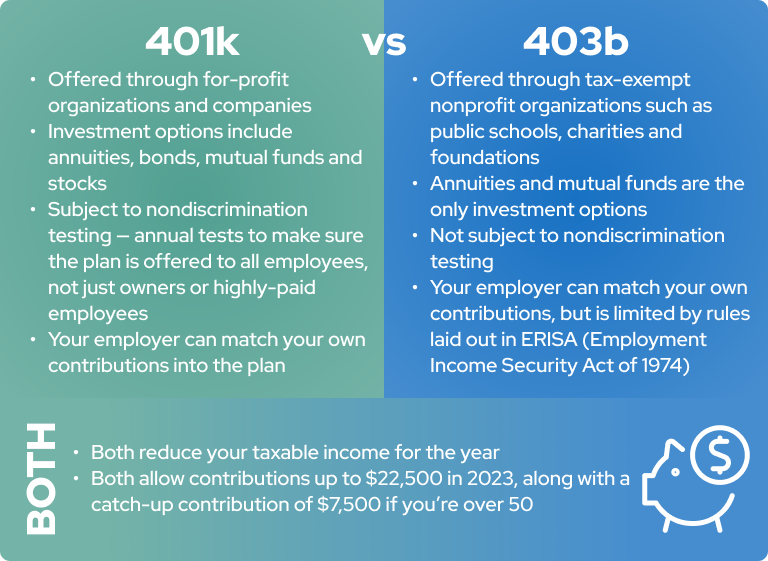

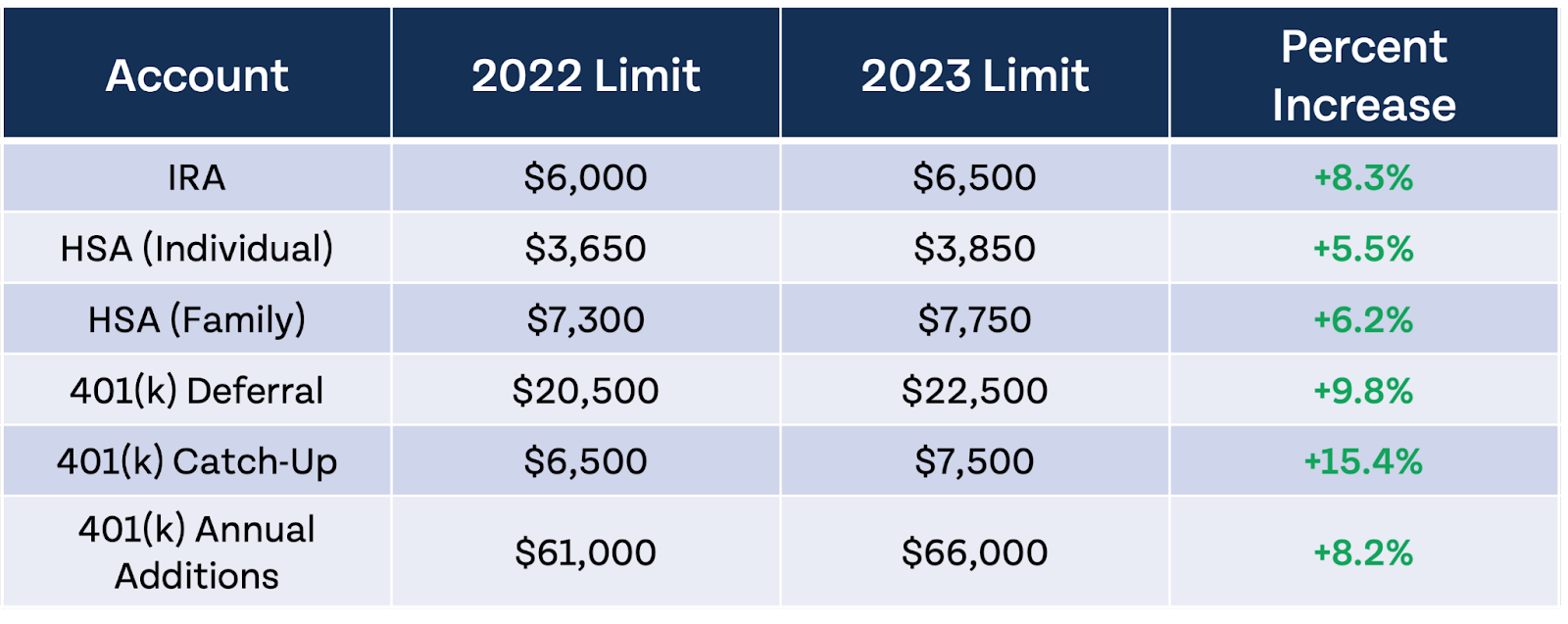

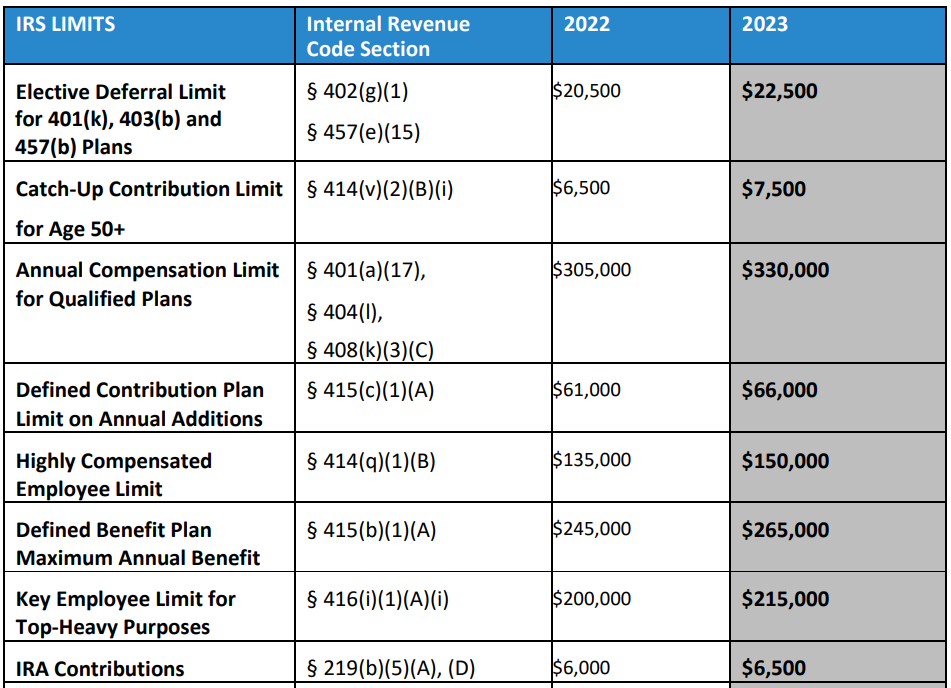

The 401k/403b/457/tsp contribution limit is $22,500 in 2023. 403 (b) contribution limits consist of two parts:

403(B) Contribution Limits In 2023 And 2024.

Contribution limits for 403(b) and 401(k) plans irs limits on 403(b)s and 401(k)s pertain to employee contributions and the total of all employee and employer.

The Annual 403 (B) Contribution Limit For 2024 Has Changed From 2023.

The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2024 (compare that.

If You Are Age 50 Or Older In.

Images References :

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, Contribution limits for 403(b) and 401(k) plans irs limits on 403(b)s and 401(k)s pertain to employee contributions and the total of all employee and employer. From $54,750 to $57,375 for head of household filers;

Source: www.annuityexpertadvice.com

Source: www.annuityexpertadvice.com

403b Calculator Calculate Your Retirement Savings (2024), Contribution limits for your retirement savings in 2024. Home » retirement planning » qualified retirement plans » 403 (b) plans » 403 (b).

Source: www.retireguide.com

Source: www.retireguide.com

403(b) Retirement Plans TaxSheltered Annuity Plans, Rollovers are subject to ira annual contribution limits and are available for 529 accounts that have been open for more than 15 years. The standard deduction has increased to $29,200 for married couples filing jointly, up $1,500 from the previous year.

Source: inflationprotection.org

Source: inflationprotection.org

Roth IRA 401k 403b Retirement contribution and limits 2023, If you are age 50 or older in. Morgan professional to begin planning your 2024.

Source: www.jdsupra.com

Source: www.jdsupra.com

Retirement Plan Contribution Limits Will Increase in 2020 Ward and, In 2024, you can contribute up to $23,000 to a 403 (b). Contribution limits for a 403(b) plan.

Source: fyi.moneyguy.com

Source: fyi.moneyguy.com

The IRS Just Announced 2023 Tax Changes!, Contribution limits for your retirement savings in 2024. Your contribution and your employer’s contributions.

Source: www.lexology.com

Source: www.lexology.com

What Are the Retirement Plan Dollar Limits for 2023? Lexology, If you have at least 15 years of service, you. Rollovers are subject to ira annual contribution limits and are available for 529 accounts that have been open for more than 15 years.

Source: www.pinterest.com

Source: www.pinterest.com

Retirement Topics 403b Contribution Limits Internal Revenue Service, The extra $500 amounts to about $23 per. Your contribution and your employer’s contributions.

Source: aegisretire.com

Source: aegisretire.com

New IRS Indexed Limits for 2024 Aegis Retirement Aegis Retirement, If you are under age 50, the annual contribution limit is $23,000. The internal revenue service recently announced the annual 403 (b) limits for 2024.

Source: www.midlandsb.com

Source: www.midlandsb.com

Plan Sponsor Update 2023 Retirement Plan Limits Midland States Bank, On your end, you can. In 2024, you can contribute up to $23,000 to a 403 (b).

If You Are Under Age 50, The Annual Contribution Limit Is $23,000.

For single filers, this number increased by $750 to.

This Means That For Savers Under 50, You Can Defer $23,000 Per Year, Or A Total Combined $69,000.

The standard deduction has increased to $29,200 for married couples filing jointly, up $1,500 from the previous year.