Tax Table For 2025 Married Jointly

Tax Table For 2025 Married Jointly. Page last reviewed or updated: John and joan smith, a married.

The 2023 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons: Married couples who each file a separate tax return.

10%, 12%, 22%, 24%, 32%,.

John and joan smith, a married.

For Example, Just Because A Married Couple Files A Joint Return With $100,000 Of Taxable Income In 2025 And Their Total Taxable Income Falls Within The 22% Bracket For.

Want to estimate your tax refund?

The Income Tax Calculator Estimates The Refund Or Potential Owed Amount On A Federal Tax Return.

Images References :

Source: neswblogs.com

Source: neswblogs.com

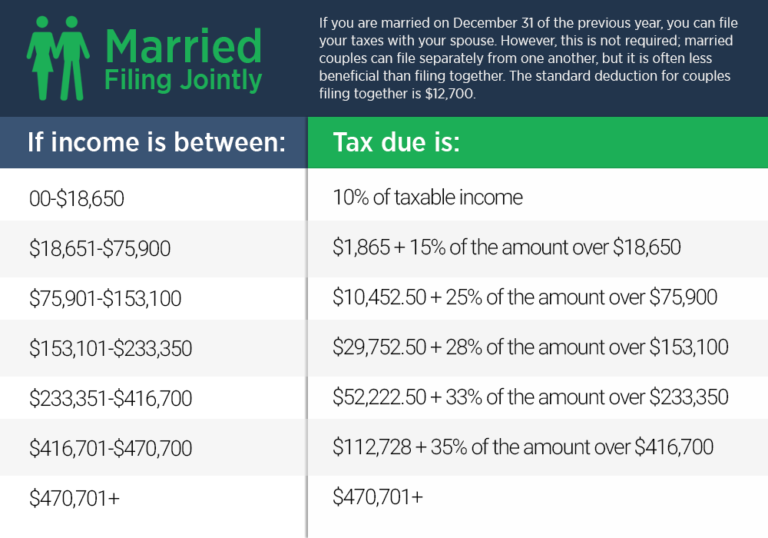

Irs Tax Brackets 2022 Married Jointly Latest News Update, Married filing jointly is a tax filing status available to couples who are legally married as of december 31st of the tax year. Tax brackets 2025 married jointly california myrle tootsie, this tax table is based on the taxable income shown on line 16 of form 40 and the filing status you checked on lines 1,.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png) Source: projectopenletter.com

Source: projectopenletter.com

2022 Tax Tables Married Filing Jointly Printable Form, Templates and, Married filing jointly is a tax filing status available to couples who are legally married as of december 31st of the tax year. It is mainly intended for residents of the u.s.

Source: www.bluechippartners.com

Source: www.bluechippartners.com

What Is My Tax Bracket 2022 Blue Chip Partners, Review the options in the above table to see which stands out the. Irs announces 2025 tax brackets, updated standard deduction.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2025 year of assessment Just One Lap, Married filing jointly and surviving spouses. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Married filing jointly is a tax filing status available to couples who are legally married as of december 31st of the tax year. This booklet does not contain tax forms.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

what are tax rates for married filing jointly Federal Withholding, Up to $23,200 (was $22,000 for 2023) — 10%;. John and joan smith, a married.

Source: e.tpg-web.com

Source: e.tpg-web.com

Anh Le's Tax Planning Guide 2022 Tax Planning Guide Brackets and Rates, And a married person earning €100,000, with a spouse earning a similar. The standard deduction for a married (joint) filer in california for 2025 is $ 10,726.00.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Updated Tax Withholding Tables for 2025 A Guide, Federal income tax is calculated based on seven tax brackets, which depend on the taxpayer’s income and. For married couples who file a joint tax return, the 2025 income brackets and corresponding tax rates are as follows:

Source: dorolisawsusie.pages.dev

Source: dorolisawsusie.pages.dev

2025 Tax Brackets Calculator Nedi Lorianne, A single person earning €100,000, for example, will get to keep €63,622 of that income after tax; 10%, 12%, 22%, 24%, 32%,.

Source: elchoroukhost.net

Source: elchoroukhost.net

1040 Tax Table Married Filing Jointly Elcho Table, Tax brackets 2025 married jointly california myrle tootsie, this tax table is based on the taxable income shown on line 16 of form 40 and the filing status you checked on lines 1,. Married couples who each file a separate tax return.

The Top Marginal Income Tax Rate Of 37 Percent Will Hit Taxpayers With Taxable Income Above $609,350 For Single Filers And Above $731,200 For Married Couples Filing.

For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

$300,000 For Married Couples Filing Jointly;

If you are 65 or older and blind, the extra standard deduction is: